Customer Stories

A leading insurance agency registered in Malaysia

Wells Insurance began its journey in 2017 as a niche specialist in commercial insurance. From humble beginnings as a two-person operation, Gan Tze Keong and his co-founder quickly identified a gap in the market: a dire need for specialized insurance services that catered to medium to large-scale businesses. Working with clients across multiple sectors and geographical locations, they specialize in nuanced risk management and insurance solutions ranging from industrial, marine, machinery, and fire insurance to employee benefits.

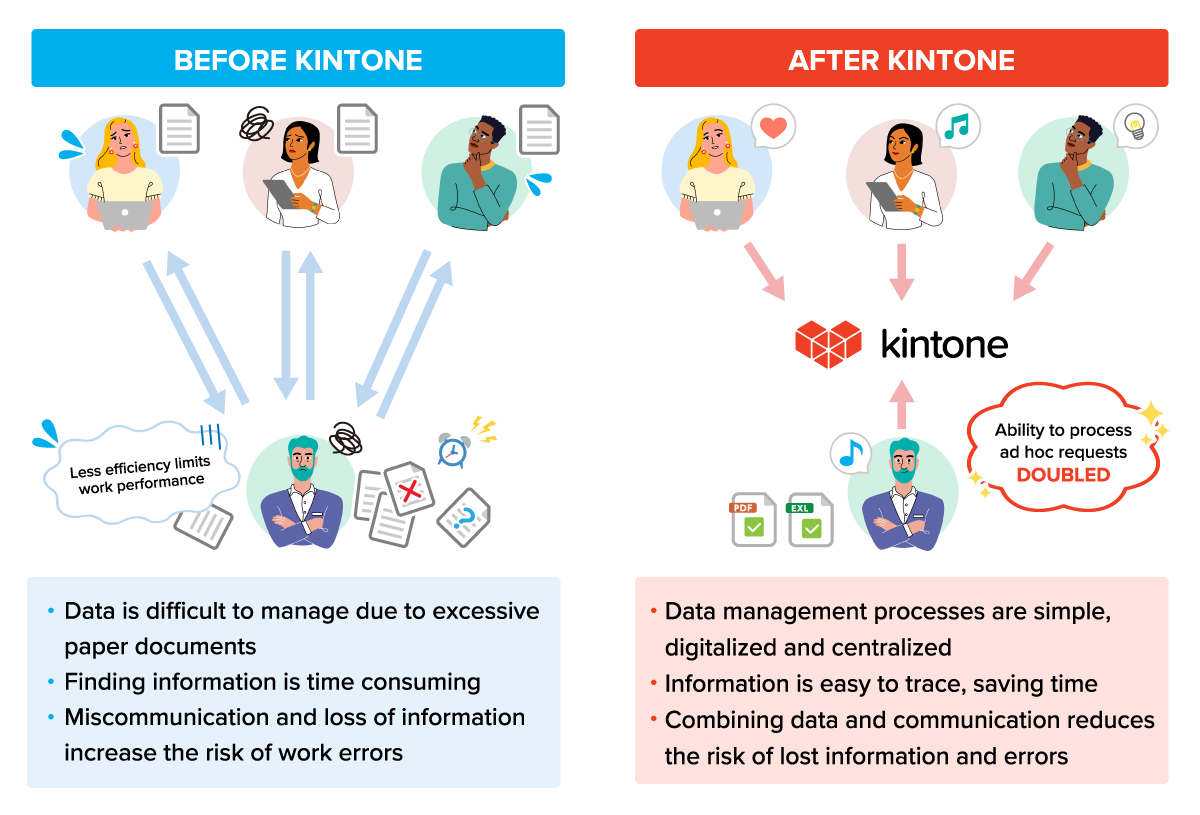

The story of their growth was not without its challenges. As their client list and policy numbers soared, Wells began facing workflow inefficiencies and a paperwork overload. In 2019, they reached a tipping point. Picture thousands of policies to manage, at least 50 pages per day, with a healthy serving of ad hoc requests on top—all without a centralized system in place! With delays and inefficiencies mounting, Wells needed a new solution.

From there, Gan identified 4 key questions that their digital solution would need to answer:

Gan soon discovered that traditional client management platforms require expensive subscription fees – the average being about MYR 100,000 per year plus MYR 50,000 for the first year of installment. Not only do these software have limited backend control, but they are often not tailor-made for intermediaries with an intricate workflow like Wells. This bottleneck was not just a productivity drain, but also a risk to customer satisfaction and business scalability. The turning point came when Gan discovered Kintone, a platform promising flexibility to build custom workflows.

Wells has about 25 employees across multiple functions including business development, servicing, accounting, legal department and a team to handle business overseas. When first implementing Kintone into their daily operations, there were a lot of doubts within the company. To kick things off, the Kintone sales team held a series of training workshops to help staff get acquainted with the software.

Starting with essential apps for policy storage and invoicing, Gan’s team quickly realized the benefits of having a central, accessible, and organized system. Kintone’s intuitive design allowed for rapid deployment and adoption, even among those with limited to no technical IT background. Before long, Kintone was providing answers to all of Gan’s key questions.

Wells’ successful integration of Kintone was made even smoother with the help of Kintone’s sales team. Throughout the process, they were instrumental in helping Gan and his team understand and utilize the platform to their advantage. The sales team set up several online demo sessions, built templates catered to Wells’ needs and demonstrated the efficacy of streamlining their processes on the platform. Ultimately, the outcomes were not only intangible benefits; they were quantifiable. The shift to a streamlined process amounted to an impressive MYR 3.5 million in revenue, which translates to a 5% increase.

On top of its revenue increase, Wells also saw a range of time-saving and efficiency benefits. With Kintone’s data management feature, searching for information is only a click away and workflows are far more optimized. Now, team members are able to streamline over 50 ad hoc requests per day, compared to between 20 and 30 requests before.

Billing, once a cluttered process done manually, is now conducted through Kintone. Around 50 debit notes are processed each day, with a reduction of over 20% on the overall time spent with invoices. Monitoring and follow-up have also become much simpler thanks to Kintone status updates.

Even without extensive software development resources, Wells is able to utilize Kintone’s intuitive no-code interface to customize and develop apps aligned with their specific processes. Now, the entire team at Wells spends about 20% of its time on Kintone, rather than having to toggle between a whole host of software platforms.

Encouraged by its initial Kintone success, Wells is keen on expanding its use of the platform to encompass even more aspects of their operations. They plan to develop a standardized quotation system that precedes the billing process to further refine workflow and enhance client interaction. By embracing Kintone, Wells not only resolved their immediate operational challenges but also laid a solid foundation for continued business growth and operational excellence.

At a critical moment in the company’s growth, Kintone’s adaptability and scalability proved to be the perfect fit for Wells.

A Quick and Painless Transition to Paperless

#Sales/Marketing Management #Data Management #Team Management #Workflow #TechnologyMaximum Solutions Corporation

From Engineering to Production -- Siam Global Engineering Leverages Kintone for Streamlined Operations and Future Growth

#Manufacturing Department #Data Management #Project Management #Workflow #Engineering #ManufacturingSiam Global Engineering Co., Ltd.

How One Person Launched His Organization's Digital Transformation

#Business Management #Data Management #Project Management #Workflow #ManufacturingGuhring Philippines Inc.

Kintone Product Introduction Video